Kindersley Lithium Project Phase 1 Preliminary Economic Assessment

Grounded PEA – Leading Lithium from Brine Project

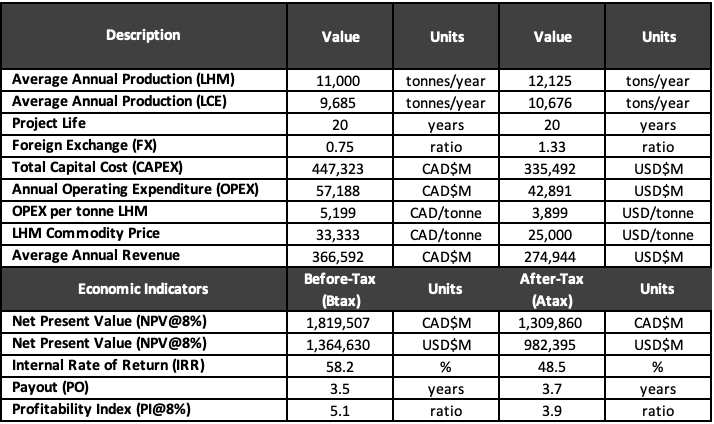

Robust Project Economics – 11,000 tonne/yr lithium hydroxide monohydrate (“LHM”) Phase 1

Grounded’s Kindersley Lithium Project competes with all other lithium companies’ economics (hard rock, Latin America lithium triangle and lithium from brine companies in Canada) Project continues to be de-risked. Sets stage for future critical project milestones

Highlights

NPV(AT) 8% USD$1.0 Billion (Phase 1)

IRR(AT) 48.5%

(Phase 1)

Total Capital USD$335 Million (Phase 1)

Capital Intensity USD$30,500/tpa

(installed tonne capacity/yr)

OPEX/yr: USD$42.9 Million (Phase 1)

OPEX/tonne produced: USD$3,899

Summary Economics

Note 1: The PEA is a preliminary cost estimate and includes inferred mineral resources that are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). There is no certainty the results of the KLP outlined by the PEA will be realized.

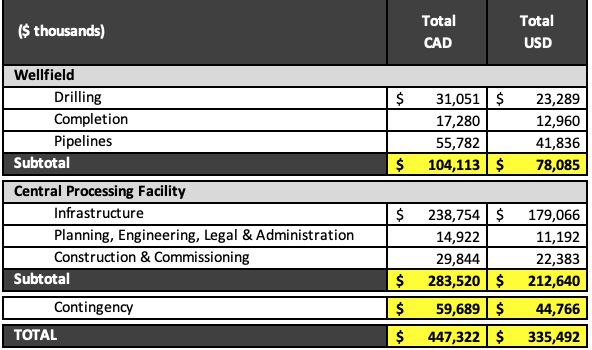

KLP Capital Cost Summary

Given the operating conditions, the capital intensity for the KLP is forecasted to be materially lower than some of the other operations in the industry. Capital efficiency is vitally important in projects of this size and the leverage that accrues to project stakeholders due to industry leading capital efficiency ratios directly impact rates of return. These capital estimates will be further refined as the Company moves toward the pre-feasibility and bankable feasibility milestones. These estimates represent a Class 5 engineering cost estimate. We do expect modifications to these estimates with the completion of more precise and detailed engineering.

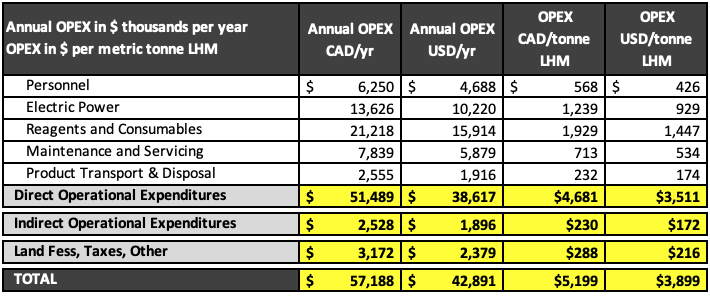

KLP Operating Cost Summary

Total operating costs of USD $42.9 million per year, or USD $3,899 per tonne of LHM, are broken out by each major project step and are inclusive of direct and indirect costs. The majority of the operating costs are associated with reagents required within the system and power consumption. For purposes of the PEA, we assumed that sufficient power can be secured from the existing grid structure. However, as we advance the KLP towards commercialization, there is the potential to construct owner secured power options such as a cogeneration unit. This would represent an additional capital charge offset by the benefit of stable, predictable, cost-efficient power supply. Excess power generated from such a unit could be sold into the existing power market to partially offset the operating costs.

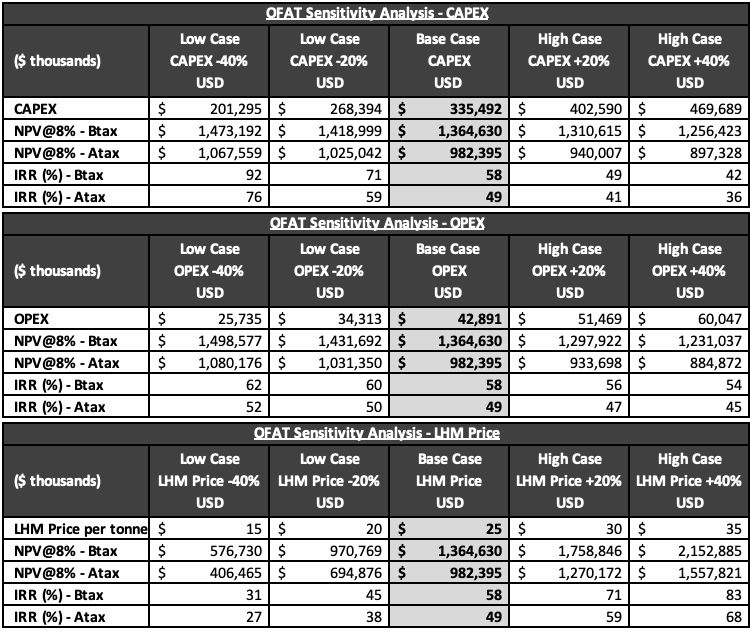

Economic Sensitivity Summary (USD)

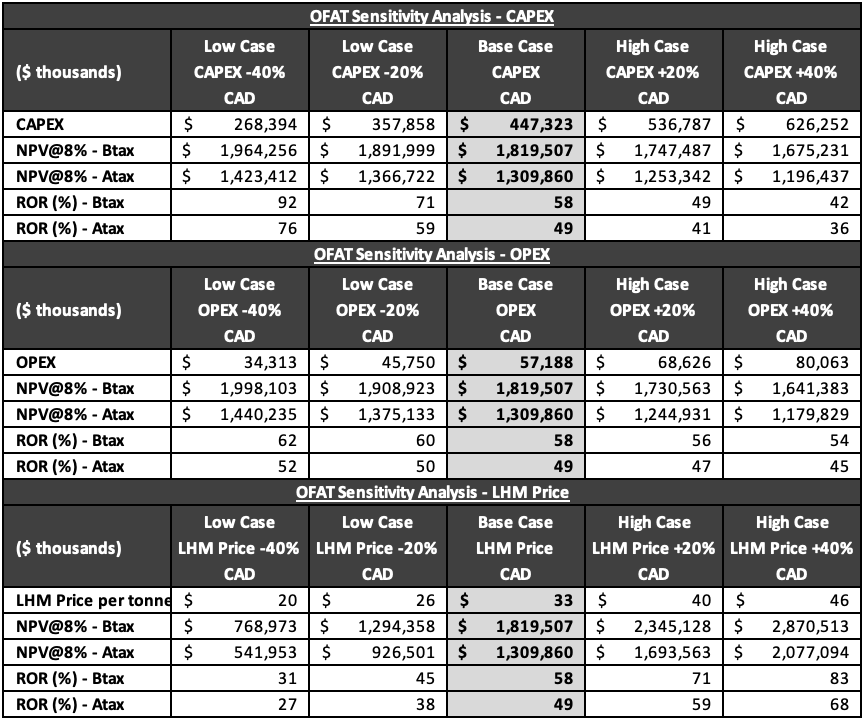

Economic Sensitivity Summary (CAD)

A detailed future pricing study for lithium chemicals was not completed for the PEA. The average price used for future sales of battery-quality LHM was developed by reviewing pricing data generated from reliable sources as reported in publicly disclosed data collected from peer companies. The future average selling price of USD $25,000/tonne for LHM is consistent with that used in publicly released economic assessments of other lithium projects in recent history. Current spot pricing for battery-grade lithium products average greater than USD $40,000/tonne, therefore the potential upside leverage to KLP economics is noteworthy.

Sensitivities demonstrate that the KLP is expected to provide torque to the upside upon any potential future increase in underlying commodity prices. With the demand for critical minerals expected to exceed world supply, the low-cost structure of the KLP is expected to provide elastic returns to the upside. The low-cost structure of the KLP was a key determinant in the Company focusing on the KLP area, since during downturns in commodity cycles, low-cost operations provide projects with improved price resilience.